Sinds de oprichting in 1971 heeft IVM een grote expertise opgebouwd in het toepassen van onderzoek op het gebied van diversiteit en complexiteit in de milieuproblematiek. Het multidisciplinaire onderzoek is in vier departementen ondergebracht: Environmental Economics, Environmental Geogaphy, Environmental Policy Analysis en Water and Climate Risk.

De missie van IVM is bijdragen aan de duurzame ontwikkeling van en de zorg voor het milieu door wetenschappelijk onderzoek en onderwijs. In het onderzoeksprogramma zoekt IVM naar innovatieve manieren om milieurelevante informatie over natuurlijke en maatschappelijke processen te verzamelen en te structureren. Het programma is geïnspireerd door het concept duurzame ontwikkeling, waarbij een geïntegreerde visie op het milieu centraal staat.

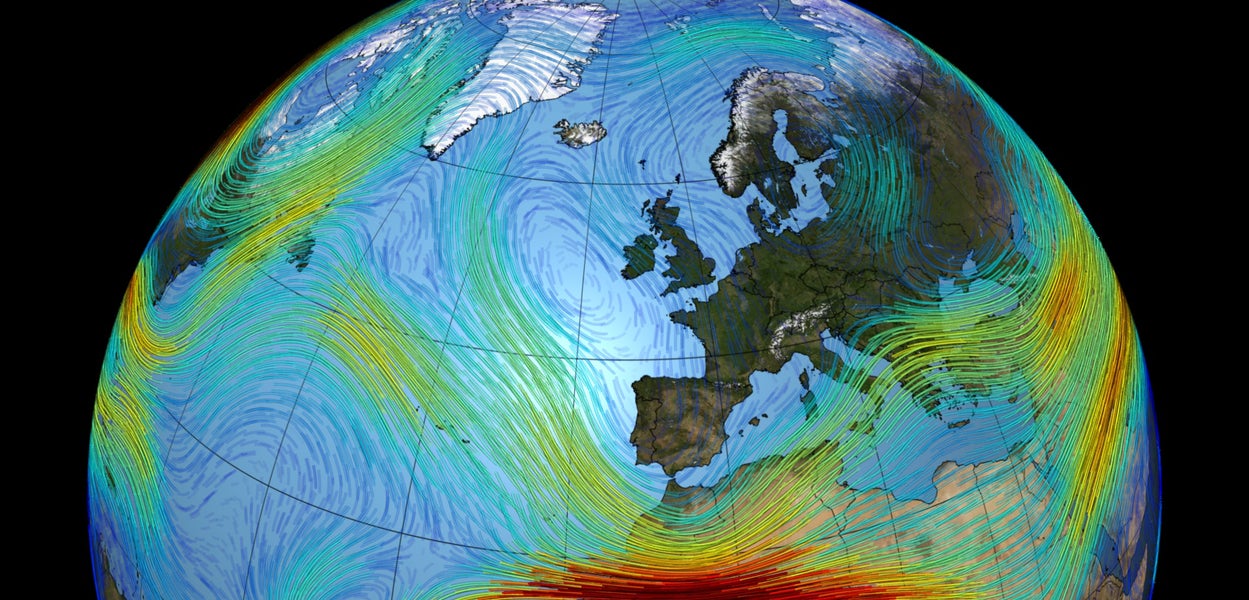

De hoofdonderwerpen van het onderzoek zijn (internationale) milieuthema’s en beleid, zoals wateroverstromingen en droogte; klimaatverandering en internationale handel; ruimtelijke milieuaspecten, met name in kust- en stroomgebieden en stedelijke gebieden; economische effecten; en industriële transformatie, met name doelend op milieumanagement in bedrijven en ontkoppeling van economische groei en milieubelasting.

Er worden verschillende technieken en methoden aangewend om deze thema’s te onderzoeken, zoals biomonitoring, beslissingsondersteunende systemen, perceptie- en participatieonderzoek, economische waardering, kosten-batenanalyse, geïntegreerde economische en milieumodellering, remote sensing en geografische informatiesystemen.

Het IVM doet veel onderzoek in opdracht voor o.a. de OECD, de Wereldbank, nationale en regionale overheden, de Europese Unie, bedrijven en NGO’s. Overig onderzoek wordt gefinancierd door NWO, KNAW en de Vrije Universiteit.

IVM maakt deel uit van de Onderzoekschool SENSE (Netherlands Research School for the Socio-Economic and Natural Sciences of the Environment). Het instituut organiseert de masteropleiding Environment and Resource Management (ERM), een eenjarige multidisciplinaire opleiding die jaarlijks wereldwijd zo’n zeventig tot honderd studenten aantrekt. Verder zijn IVM-onderzoekers als docenten betrokken bij andere Masterprogramma's zoals Hydrology, Global Environmental Change and Policy (GEC&P), en tenslotte bij de Bacheloropleiding Aarde, Economie en Duurzaamheid.

Meer informatie over het instituut vind je op de Engelstalige website van het Instituut voor Milieuvraagstukken.